A Full Guidance

Starting and maintaining a legal freelance career in Malta is straightforward but requires attention to registration, tax obligations, social security, and proper record keeping. Below is detailed guidance to ensure you stay compliant and protected as a freelancer in Malta.

1. Register as Self-Employed

⦁ Local Registration:

All freelancers must register as self-employed with Jobsplus (Malta’s employment authority). This involves submitting a self-employment engagement form, available from the Jobsplus website or office.

⦁ EU & Non-EU Residents:

Non-EU nationals need a valid residence permit before registering. Maltese nationals or EU citizens can proceed directly to registration.

⦁ Tax Number:

Apply for a tax number through the Office of the Commissioner for Revenue if you do not already have one.

⦁ Tax Number:

Apply for a tax number through the Office of the Commissioner for Revenue if you do not already have one.

2. Income Tax for Freelancers

⦁ Taxable Income:

Tax is paid on net profit (total income minus allowable business expenses)

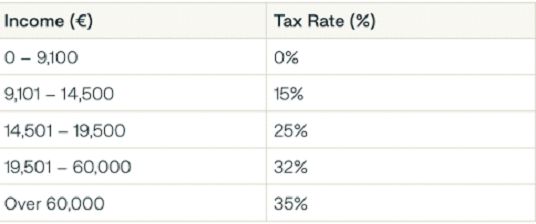

⦁ Income Brackets (2025):

If you’re part-time and meet specific conditions, a flat 10% or 15% rate up to €12,000 may apply.

⦁ Tax Filing:

File your tax return and pay tax due six months after the end of the calendar year (typically by end of June).

⦁ Remittance Basis (non-domiciled):

If you’re a resident but not domiciled in Malta, you may be taxed only on Malta-sourced income and foreign income remitted to Malta.

3. Social Security Contributions

⦁ Obligation:

Freelancers earning over €910 annually must pay Class Two social security contributions. This secures your pension, healthcare, and other social benefits.

⦁ Contribution Rate:

Typically 15% of previous year’s net self-employed income.

⦁ Payment Schedule:

Pay contributions quarterly directly to the Commissioner for Revenue.

⦁ EU Exemptions:

If you contribute to another EU country’s system, you may be exempt—ensure you have evidence/documentation.

⦁ EU Exemptions:

If you contribute to another EU country’s system, you may be exempt—ensure you have evidence/documentation.

4. VAT Registration and Invoicing

⦁ VAT Threshold for Services:

You must register for VAT if your annual turnover exceeds €30,000.

⦁ VAT Rates:

- Standard: 18%

- Reduced rates (5% or 7%) apply in select industries/activities.

- Registration: Register online at the Office of the Commissioner for Revenue or at their office.

• VAT-Exempt Registration:

If below threshold, you can register under Article 11 for VAT exemption but must still provide fiscal receipts for every transaction.

• Invoicing Rules:

5. Record-Keeping

⦁ Accurate Bookkeeping:

Maintain up-to-date income and expense records, supporting invoices, purchase orders, and bank statements.

⦁ Retention:

Records must be retrievable for at least 10 years in case of auditing.

6. Filing Deadlines & Miscellaneous Tips

⦁ Tax Returns:

File by end of June following the tax year. Flat rate part-time filings may be due by end of April if you qualify for the lower rate.

⦁ Separate Bank Account:

Strongly advised to open a dedicated business bank account for all freelance transactions.

⦁ Permits:

Some services require specific permits/licenses. Check with Business First Malta if in doubt.

⦁ Professional Help:

Maltese tax can be complex—consult a qualified accountant for personalized advice on deductions, tax residence issues, or double taxation treaties.

⦁ Professional Help:

Maltese tax can be complex—consult a qualified accountant for personalized advice on deductions, tax residence issues, or double taxation treaties.

7. Checklist for Freelancers Starting in Malta

⦁ Register as self-employed at Jobsplus

⦁ Apply for a tax number (Office of the Commissioner for Revenue)

⦁ Obtain a social security number and register for NI contributions

⦁ Register for VAT if turnover exceeds €30,000

⦁ Set up accurate bookkeeping and invoicing practices

⦁ Stay aware of annual deadlines for taxes and social security

Staying legal as a freelancer in Malta protects your income, health, and business reputation. Diligently following these steps means you’ll operate worry-free and can confidently approach new clients and projects.

Contact details

Office of the Commissioner for Revenue

Address: Carob Tree Complex, Tower Street, Birkirkara BKR 4012, Malta

Phone: +356 2133 6444

Email: info.cfr@gov.mt

Website: www.revenue.gov.mt

VAT Department (part of Commissioner for Revenue)

Address: Same as above

Phone: +356 2133 6444

Email: vat.cfr@gov.mt